All About Pvm Accounting

All About Pvm Accounting

Blog Article

4 Easy Facts About Pvm Accounting Explained

Table of ContentsThe Ultimate Guide To Pvm AccountingPvm Accounting for BeginnersAn Unbiased View of Pvm AccountingGetting The Pvm Accounting To WorkThe Basic Principles Of Pvm Accounting The Single Strategy To Use For Pvm AccountingThe Best Strategy To Use For Pvm AccountingThe 15-Second Trick For Pvm Accounting

One of the primary factors for executing accounting in building and construction jobs is the need for monetary control and management. Audit systems provide real-time understandings into task expenses, income, and profitability, making it possible for task supervisors to without delay recognize potential issues and take restorative actions.

Construction jobs are subject to various financial requireds and coverage requirements. Proper accounting ensures that all financial purchases are tape-recorded properly and that the project complies with audit criteria and legal agreements.

Pvm Accounting for Dummies

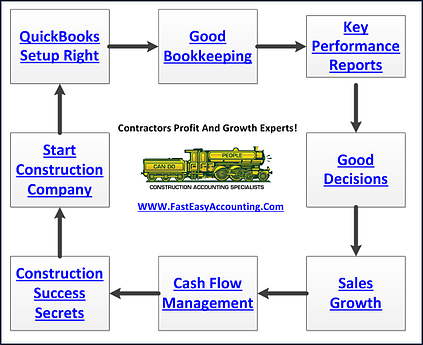

This minimizes waste and boosts project efficiency. To better understand the importance of bookkeeping in construction, it's also important to distinguish in between building management audit and task administration bookkeeping. primarily concentrates on the monetary aspects of the construction company as a whole. It deals with overall monetary control, budgeting, capital administration, and financial reporting for the whole company.

It concentrates on the economic aspects of specific construction tasks, such as cost estimate, price control, budgeting, and money circulation monitoring for a particular project. Both sorts of audit are vital, and they enhance each other. Building administration accounting makes sure the firm's financial health and wellness, while task monitoring accounting makes sure the financial success of individual jobs.

Everything about Pvm Accounting

An important thinker is needed, who will certainly collaborate with others to choose within their areas of duty and to surpass the areas' job procedures. The setting will connect with state, college controller staff, campus department team, and academic researchers. This individual is expected to be self-directed once the initial knowing contour is overcome.

4 Simple Techniques For Pvm Accounting

A Building and construction Accounting professional is accountable for handling the financial aspects of construction projects, including budgeting, cost tracking, financial coverage, and conformity with regulative needs. They function closely with task managers, contractors, and stakeholders to ensure exact financial documents, expense controls, and timely payments. Their competence in building and construction accounting concepts, job setting you discover here back, and economic analysis is vital for reliable economic monitoring within the construction market.

The Definitive Guide to Pvm Accounting

As you have actually most likely learned now, taxes are an inevitable component of doing organization in the United States. While a lot of focus normally pushes federal and state income tax obligations, there's additionally a 3rd aspectpayroll taxes. Pay-roll tax obligations are taxes on an employee's gross salary. The revenues from pay-roll tax obligations are utilized to fund public programs; because of this, the funds collected go straight to those programs as opposed to the Irs (IRS).

Note that there is an additional 0.9% tax for high-income earnersmarried taxpayers that make over $250,000 or single taxpayers making over $200,000. Earnings from this tax go towards federal and state joblessness funds to aid workers that have lost their work.

The 25-Second Trick For Pvm Accounting

Your down payments must be made either on a month-to-month or semi-weekly schedulean political election you make before each fiscal year. Monthly repayments. A monthly repayment has to be made by the 15th of the adhering to month. Semi-weekly payments. Every other week deposit days depend on your pay routine. If your cash advance drops on a Wednesday, Thursday or Friday, your deposit is due Wednesday of the following week.

Take care of your obligationsand your employeesby making full pay-roll tax obligation repayments on time. Collection and settlement aren't your only tax obligation responsibilities.

Pvm Accounting for Beginners

Every state has its very own unemployment tax obligation (called SUTA or UI). This is due to the fact that your business's market, years in business and joblessness history can all establish the portion utilized to compute the quantity due.

The Ultimate Guide To Pvm Accounting

The collection, remittance and coverage of state and local-level taxes depend on the governments that levy the taxes. Clearly, the subject of pay-roll taxes includes plenty of moving parts and covers a broad range of audit knowledge.

This website uses cookies to improve your experience while you navigate through the site. Out of these cookies, the cookies that are categorized as necessary are stored on your browser as they are vital for the working of fundamental capabilities of the web site. We likewise utilize third-party cookies that assist us evaluate and understand just how you use this internet site.

Report this page